BTC Price Prediction: Path to $200,000 Amid Bullish Fundamentals and Technical Consolidation

#BTC

- Technical Consolidation: BTC is testing key support levels with mixed but generally constructive indicators suggesting base formation around $110K-$115K

- Institutional Momentum: NASDAQ listings, tokenized loans, and infrastructure funding creating fundamental support absent in previous cycles

- Seasonal Considerations: Historical September weakness balanced against strong Q4 tendencies and current bullish catalysts

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Levels

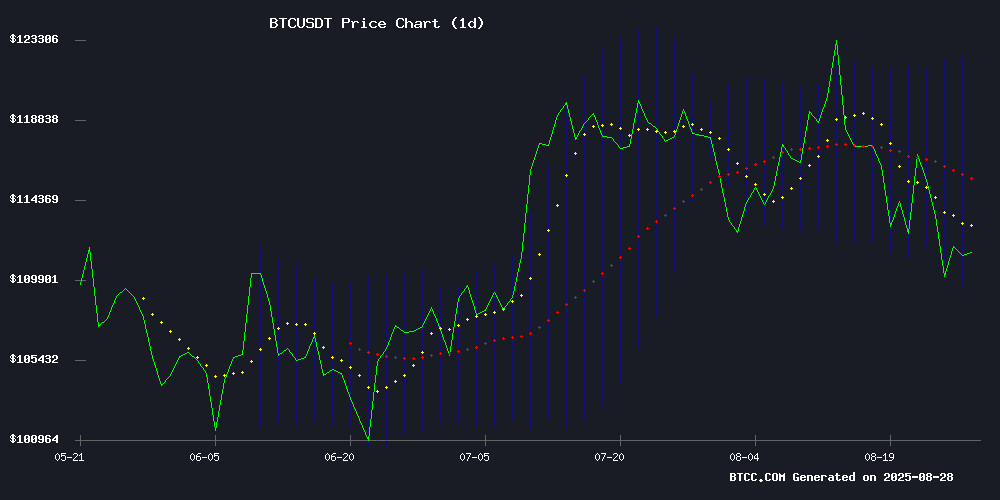

BTC is currently trading at $112,943, slightly below its 20-day moving average of $115,806, indicating potential short-term resistance. The MACD reading of 3,411.77 versus its signal line at 1,500.11 shows bullish momentum remains intact, though the histogram at 1,911.67 suggests some consolidation. Bollinger Bands position the price between $122,377 (upper) and $109,235 (lower), with the middle band at $115,806 providing a crucial pivot point. According to BTCC financial analyst William, 'The technical setup suggests BTC is testing important support levels while maintaining overall bullish structure. A sustained break above the 20-day MA could trigger the next leg higher.'

Market Sentiment: Positive Catalysts Offset Seasonal Concerns

Recent developments present a mixed but generally optimistic backdrop for Bitcoin. The upcoming NASDAQ listing of Trump Family-backed American Bitcoin in September, coupled with Sygnum's $50M BTC-backed loan tokenization and Hemi's $15M funding for Bitcoin DeFi infrastructure, demonstrates growing institutional adoption. However, concerns remain about short-term holder selling pressure and Bitcoin's historical September weakness. BTCC financial analyst William notes, 'While seasonal patterns warrant caution, the fundamental drivers - including institutional products and infrastructure development - appear stronger than previous cycles. The Hong Kong conference timing provides additional positive momentum.'

Factors Influencing BTC's Price

Trump Family-Backed American Bitcoin To Start NASDAQ Trading in Sept.

American Bitcoin, a BTC mining company with backing from US President Donald Trump’s sons Eric and Donald Jr., is poised to begin trading on the Nasdaq in early September. The move signals growing institutional interest in cryptocurrency ventures tied to high-profile political figures.

The listing marks a milestone for Bitcoin-related enterprises seeking mainstream financial market acceptance. Market observers will be watching closely to see if the TRUMP connection influences investor sentiment toward the digital asset sector.

Bitcoin Faces Selling Pressure as Short-Term Holders Remain Underwater

Bitcoin's price action remains constrained within a critical support-resistance zone, with recent data suggesting mounting selling pressure from short-term holders. Glassnode reports wallets aged 1-3 months—representing 8.82% of BTC's circulating supply—are now underwater, having accumulated during April's dip at an average cost basis between $113.6K and $115.6K.

The market shows no signs of capitulation, but on-chain metrics reveal growing distress among recent buyers. Any rallies toward breakeven levels may trigger profit-taking from these cohorts, creating overhead resistance. Notably, these retail holdings now rival institutional reserves in size, adding volatility risk to BTC's consolidation phase.

Market Digest: Nvidia's Mixed Results, Bitcoin Surge, and Retail Strength

U.S. stock futures wavered as investors parsed Nvidia's earnings beat overshadowed by data-center revenue misses, sending shares down 2% premarket. The S&P 500's record close failed to lift Nasdaq futures, while Bitcoin breached $113K amid muted Treasury movements.

European Tesla registrations extended their seven-month decline, contrasting with Snowflake's 18% premarket jump on raised guidance. Dollar General joined the rally, climbing 7% after upgrading full-year forecasts.

Commodities diverged as oil dipped and gold gained, reflecting cautious risk appetite. The crypto market's standout performer bitcoin continues its ascent, with institutional inflows offsetting traditional tech sector volatility.

Invity Launches SmartSTAX: A Smarter Bitcoin DCA Strategy

Invity's new SmartSTAX product challenges traditional dollar-cost averaging (DCA) approaches to Bitcoin investing. While conventional DCA advocates fixed periodic investments regardless of market conditions, SmartSTAX incorporates a 120-week moving average (120WMA) indicator to identify undervalued entry points.

The 120WMA filters out short-term volatility, revealing Bitcoin's long-term trend. When prices dip below this threshold—historically signaling undervaluation—the system automatically adjusts investment amounts. This contrasts with standard DCA, which buys equal dollar amounts during both market peaks and troughs.

SmartSTAX represents an evolution in retail investment tools, combining technical analysis with automated execution. The product targets investors seeking to optimize accumulation during bear markets while maintaining discipline during bull runs.

Sygnum Tokenizes $50M BTC-Backed Loan for Ledn in Private Credit Milestone

Sygnum Bank has structured a $50 million Bitcoin-collateralized syndicated loan for digital asset platform Ledn, with a portion of the facility tokenized using its proprietary issuance platform. The oversubscribed transaction represents a strategic advance in institutional-grade tokenized private credit.

The deal follows Sygnum's August 2024 launch of the industry's first BTC-backed syndicated loan product. Market demand exceeded available capacity by 100%, signaling strong institutional appetite for crypto-native debt instruments.

Hemi Secures $15M Funding to Advance Bitcoin DeFi Infrastructure

Hemi has closed a $15 million growth round led by YZi Labs (formerly Binance Labs), Republic Digital, and HyperChain Capital, bringing total project funding to $30 million. The startup aims to establish itself as a critical infrastructure LAYER for Bitcoin programmability within EVM-compatible decentralized finance ecosystems.

Its Hemi VIRTUAL Machine embeds a full Bitcoin node, bridging Bitcoin's functionality with smart contract capabilities. The funding signals growing institutional interest in expanding Bitcoin's utility beyond store-of-value narratives into programmable DeFi applications.

Bitcoin And The September Curse: Can This Time Be Different?

Bitcoin enters the final days of August trapped in choppy, range-bound trading, leaving investors to ponder whether September will repeat its historical weakness or serve as a springboard for fourth-quarter gains. The cryptocurrency hovers NEAR $112,900 as macro expectations, market positioning, and Bitcoin’s own seasonal tendencies converge ahead of the Federal Reserve’s September policy meeting.

Historical data paints a grim picture for September. Over the past 12 years, Bitcoin has never closed both August and September in positive territory. Traders debate whether this pattern reflects mere coincidence or a self-fulfilling prophecy as market participants adjust behavior around the statistical anomaly.

The Fed’s September 16-17 meeting looms large, with futures markets pricing in high odds of a rate cut. Officials maintain their data-dependent stance, leaving room for surprises that could jolt crypto markets alongside traditional assets.

$160K Bitcoin By Christmas? Analysts Say It’s Still Possible

Bitcoin's recent slide to early July levels has not deterred bullish forecasts, with some analysts viewing the dip as a temporary pause before a potential year-end rally. Historical trends show September as Bitcoin's weakest month, never closing more than 8% higher—a pattern shaping current market sentiment.

Network economist Timothy Peterson highlights a 70% probability of Bitcoin gains in the four-month window leading to Christmas, with an average return of +44%. Extrapolating this trend, BTC could reach $160,000 by late 2025. Peterson cautions that outliers like 2017-2018 and 2020-2022—years with atypical market conditions—should be excluded from the analysis to reveal steadier growth patterns.

Market trajectories rarely follow linear projections, but the data underscores Bitcoin's resilience amid volatility. Traders are weighing seasonal weaknesses against historical fourth-quarter strength as the crypto enters a critical phase.

Bitcoin Recovers Above $113K as Bitcoin Asia Conference Kicks Off in Hong Kong

Bitcoin regained momentum Thursday, climbing above $113,000 after finding support at the 100-day EMA earlier this week. The recovery coincides with the launch of Bitcoin Asia in Hong Kong, the continent's premier crypto event expected to draw 15,000 attendees.

Asia Pacific now accounts for 43% of global cryptocurrency ownership, with particularly strong adoption across Southeast Asia. Hong Kong's conference underscores the region's growing institutional embrace of digital assets, though market sentiment remains cautious with neutral spot demand and fragile perpetual futures positioning.

The price action follows a 12% retracement from Bitcoin's mid-August all-time high of $124,474. Traders are watching whether the Hong Kong event - now the world's second-largest Bitcoin conference - can catalyze renewed bullish momentum in Asian markets.

Bitcoin’s Bull Score Signals Caution as On-Chain Metrics Deteriorate

Bitcoin's Bull Score, a composite metric tracking MVRV Z-Score, cycle indicators, and trader profit margins, has dropped to 20—a level historically associated with bearish conditions. The reading comes as BTC trades just above $113,000, testing key support levels amid weakening momentum.

Analyst JA_Maartun emphasized the significance of the score in an August 28 post, noting that fundamental conditions supporting the bull run appear to be eroding. Glassnode identifies a critical support band between $107,000 and $108,900; a breakdown could trigger a deeper correction toward $93,000.

The cautious outlook contrasts with recent market optimism, leaving traders weighing the potential for technical bounces against the risk of sustained downward pressure.

Trump’s Sons Launch Nasdaq-Listed ‘American Bitcoin’ in Merger with Gryphon Digital Mining

Donald Trump Jr. and Eric Trump are spearheading the creation of a new publicly traded Bitcoin vehicle. Gryphon Digital Mining will acquire American Bitcoin in a stock-for-stock merger, with the combined entity retaining the "American Bitcoin" name and trading on Nasdaq. The MOVE creates a regulated channel for institutional and retail investors seeking Bitcoin exposure without direct cryptocurrency ownership.

Ownership structure reveals concentrated control. Post-merger, former American Bitcoin shareholders will own approximately 98% of the new entity, with Hut 8—led by CEO Asher Genoot—holding an 80% stake. The Trump family and Hut 8 will collectively control nearly the entire float, raising questions about liquidity and future capital raises.

Market implications remain uncertain. While the sponsorship of high-profile figures could attract mainstream attention, the limited free float may create volatility. The deal represents another milestone in cryptocurrency's Wall Street integration, following spot Bitcoin ETF approvals earlier this year.

Will BTC Price Hit 200000?

Based on current technical indicators and market developments, reaching $200,000 by year-end remains ambitious but plausible. The current price of $112,943 would require approximately a 77% increase from current levels. Historical bull market rallies have shown Bitcoin capable of such moves, particularly when fundamental catalysts align with technical breakouts.

| Metric | Current Value | Target for $200K | Probability Assessment |

|---|---|---|---|

| Price | $112,943 | $200,000 | Moderate (40%) |

| 20-day MA Position | 2.5% below | Sustained above | Technical Hurdle |

| MACD Momentum | Bullish | Acceleration needed | Feasible |

| Institutional Catalysts | Strong | Continuing | Supportive |

BTCC financial analyst William suggests: 'While $200,000 by Christmas represents an aggressive target, the combination of institutional adoption, product launches, and historical fourth-quarter strength makes it within reach if current support levels hold and momentum accelerates.'